Have you ever reviewed a medical bill for an older family member and wondered if every charge was necessary? Senior healthcare often involves multiple providers and complicated insurance claims, which makes it easier for fraud to slip through unnoticed. Experts at our recent health conference explained that this problem is becoming increasingly common, leaving seniors vulnerable to charges they should never have faced.

Adding to the concern, the Health 2.0 Conference urged families and caregivers to report a scam if they encountered one. What appears to be a routine charge for a consultation or test is an inflated or fabricated expense. For many seniors, this means financial strain and a growing mistrust in the very system meant to protect their health.

Let’s dive in to explore how billing fraud works, the tactics behind these scams, and the practical steps families can take to keep older adults safe.

Tactics Fraudsters Use In Senior Healthcare

Deceptive billing practices are not always obvious, yet they remain one of the most persistent threats in elder care. Fraudulent providers exploit medical coding systems, vague descriptions, and the trust seniors place in healthcare professionals. These strategies are subtle, but when repeated, they lead to significant financial losses. Experts at our health conference described some of the scam offenses families should watch for:

- Phantom billing occurs when providers charge for services never performed, leaving patients unknowingly paying for nonexistent treatments.

- Upcoding involves billing for a more complex or expensive procedure than the one actually provided, thereby inflating the cost of simple visits.

- Unnecessary tests are often framed as preventive care, but in reality, they are added purely to increase revenue.

- Double-billing happens when the same charge appears multiple times, either on the same bill or across separate statements.

These tactics are deliberately designed to blend in with legitimate charges, which is why many families miss them. A careful review of billing details remains the first line of defense against this type of fraud.

Spotting Warnings Before Fraud Takes Hold

Families may not always recognize the early signs of billing irregularities. For seniors, who may already feel overwhelmed by medical systems, these subtle patterns are tough to detect. Subtle charges that look harmless at first can quietly turn into costly scam offenses if left unchecked.

- Duplicate charges for the same service or procedure are a strong signal of fraud, especially when they appear on different statements without explanation.

- Generic billing terms, such as “consultation” or “therapy session,” without detailed information can conceal inflated charges, leading patients to believe they are paying for legitimate care.

- Providers who delay or resist giving itemized statements often have something to conceal, and this behavior should not be ignored.

- Bills that include services or tests never discussed with the patient may point to deliberate padding of charges, creating unnecessary financial strain.

When families pay closer attention to these warnings, they are more likely to stop billing issues before they create lasting harm. Experts at our global health conference 2025 highlighted billing fraud as a growing problem, stressing that even minor inconsistencies in paperwork can indicate larger patterns of deception.

How Billing Fraud Impacts Seniors Beyond Finances

The effects of billing fraud extend far beyond financial losses. For many older adults, unexpected charges or confusing paperwork create stress and reduce confidence in the care they receive. That stress can lead to delays in seeking medical attention, as patients may fear additional scam offenses hidden in their statements. Over time, persistent doubts about whether a bill is genuine or inflated begin to erode trust in doctors and healthcare providers, leaving seniors unsure of where to turn. This erosion of confidence doesn’t just affect individuals—it weakens the healthcare system as a whole, making transparency and accountability more critical than ever.

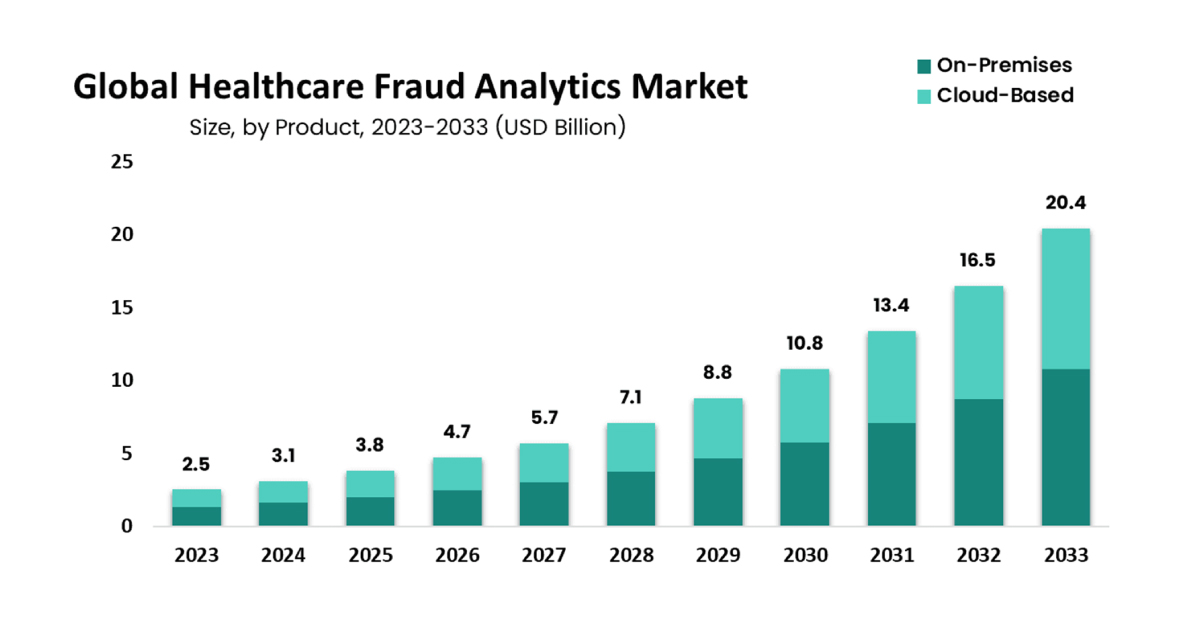

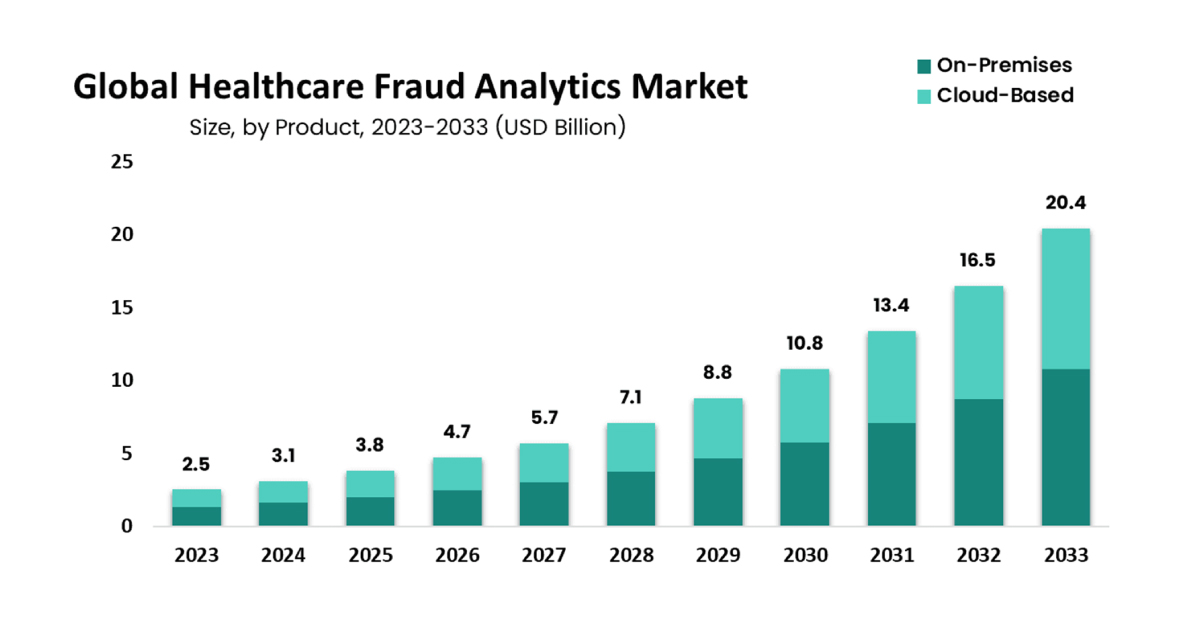

Source: MarketUs

The Healthcare Industry’s Fight Against Billing Scam Offenses

The healthcare industry is beginning to take billing fraud more seriously, recognizing its damaging impact on seniors and their families. Hospitals, insurers, and regulators are tightening oversight to ensure suspicious billing practices don’t slip through unchecked. Technology is playing a major role in this effort, with new tools designed to detect patterns that suggest abuse before they reach patients.

At the Health 2.0 Conference, discussions highlighted how a fraud monitor can serve as an early-warning system across healthcare networks. By tracking irregular billing codes, duplicate claims, and inflated charges, these monitoring systems can flag potential scam offenses in real time. The goal is not only to stop fraud before it drains financial resources but also to rebuild trust for patients who rely on the system for their care.

This growing reliance on technology is accompanied by increased collaboration between providers and policymakers. Together, they are working to create a safer environment where transparency is the standard and seniors no longer have to question whether their bills are genuine.

Steps Seniors & Families Can Take To Stay Protected

Healthcare billing can feel intimidating, but families can take practical steps to protect seniors from fraud. Prevention begins with awareness, and consistency makes these habits effective over time. Here are key actions experts recommend:

- Always request a detailed, itemized bill for every medical service, which makes it easier to spot charges that don’t belong.

- Maintain a record of all appointments and treatments, creating a simple checklist to compare against billing statements.

- Report suspicious charges to insurers or regulators immediately, since early action can stop ongoing scam offenses.

- Seek guidance from trusted caregivers or advocates when reviewing complex paperwork, so errors and manipulations are not overlooked.

These actions may seem simple, but they carry significant weight. Families who stay engaged in the billing process create an additional layer of protection for seniors and help reduce the likelihood of billing fraud occurring. Discussions at the global health conference 2025 highlighted scam offenses related to misleading charges, duplicate claims, and inflated bills, demonstrating how consistent monitoring can help prevent seniors from becoming victims.

Insights From Health Conference’s Experts To Tackle Scam Offenses

Senior healthcare deserves to be a space of trust, yet billing fraud continues to weaken that foundation for families. What this blog has shown is that the threat is not only financial but also emotional, eroding confidence in the care system itself. Tackling these issues requires vigilance at every level, and discussions at our recent health conference reminded families that even minor billing irregularities can signal much larger problems.

Insights shared at the Health 2.0 Conference reinforced that addressing scam offenses is not about reacting after harm is done, but about building stronger systems of prevention. With tools such as fraud monitoring, family education, and industry-wide collaboration, the path forward is clear. By combining awareness with action, healthcare can move closer to an environment where seniors feel protected, supported, and confident that their well-being takes priority over all else.

FAQs

1. What makes seniors more vulnerable to billing fraud than other age groups?

A. Seniors often manage multiple treatments and providers, which leads to complex billing. This complexity, combined with trust in healthcare professionals, makes it easier for fraudulent charges to slip through unnoticed.

2. How can families talk to seniors about fraud without causing fear?

A. Conversations should be framed around empowerment rather than suspicion. By showing seniors how reviewing bills protects their health and finances, families can create a sense of partnership instead of worry.

3. What should be done if a suspicious charge is found?

A. The first step is to request clarification from the provider. If answers are vague or unsatisfactory, families should report the concern to insurers or regulatory bodies to register a scam.

4. Are scam offenses a recurring theme at the Health 2.0 Conference?

A. Yes, billing fraud and scam offenses are addressed regularly because they continue to evolve. Each year, the conference introduces new insights on how to stay ahead of these threats. To learn more about the topics that will be covered at our health conference, please check out the agenda: www.health2conf.com/dubai-2025.

5. Why is the Health 2.0 Conference considered a credible source on fraud prevention?

A. The conference brings together healthcare professionals, policymakers, and technology experts. This mix ensures that insights on fraud are practical, evidence-based, and supported by multiple perspectives.