Have you ever been charged for a medical appointment you never scheduled or attended? As telehealth services become more popular, so do deceptive practices that exploit system gaps. One of the most concerning issues is the rise of phantom telehealth bills, which refer to unauthorized charges for consultations that never happened. These silent charges often go unnoticed until patients receive confusing statements or unexpected insurance notifications.

This growing concern was brought to light during discussions at our 2025 global health conference, where healthcare leaders explored how digital convenience can also open doors to billing-related fraud. Conversations at the Health 2.0 Conference emphasized the importance of reporting a scam promptly when suspicious billing activity is detected, especially as scam offenses continue to rise in virtual care. As more care shifts online, the need for stronger oversight and patient education has never been more urgent.

Let’s explore how phantom billing scams operate, who they target, and what you can do to stay protected in today’s digital healthcare ecosystem.

Rise Of Phantom Billing In Telemedicine

As telemedicine continues to reshape how people access care, it also opens the door to new billing vulnerabilities that scammers are quick to exploit. Unlike traditional healthcare, where billing issues are easier to track and question, virtual care has triggered a troubling trend of patients being charged for services they never actually received. These phantom bills often involve fabricated appointments or unauthorized follow-ups that move through automated systems without proper verification. Some bad actors impersonate legitimate providers, while others manipulate platform loopholes to submit false claims quietly. These offenses typically go unnoticed until a patient spots an unexpected charge or receives a confusing statement, and they are too often dismissed as routine errors instead of being flagged as deliberate fraud.

How Phantom Charges Sneak Into Your Telehealth Records

Have you ever noticed a strange line item on your insurance statement and thought, “Wait, I never had that appointment”? That’s how phantom charges quietly make their way into your telehealth records. These false entries often originate from fabricated consultations, auto-generated follow-ups, or duplicate claims that slip through when billing systems aren’t cross-checked against actual appointments.

In some cases, platforms may not require confirmation that a visit happened before submitting the charge, especially when multiple departments or providers are involved. Scammers take advantage of this lack of verification, counting on patients to miss small or technical billing details. When combined with complex codes and vague service descriptions, these charges blend in easily—making it all the more important to stay alert, question what doesn’t look right, and report anything suspicious immediately.

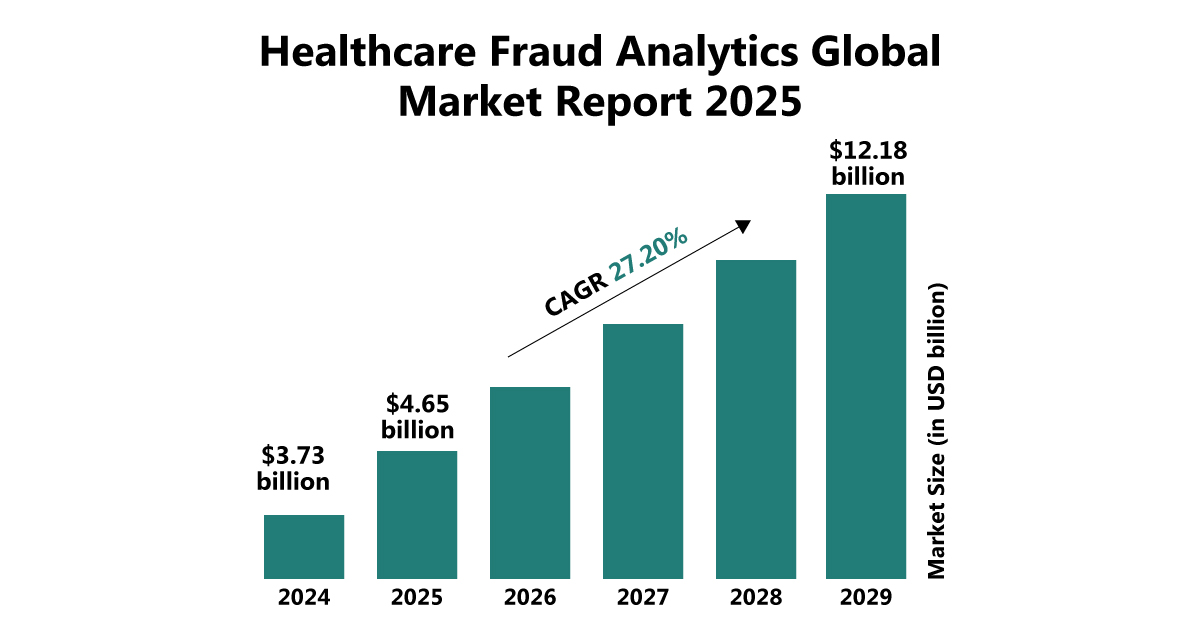

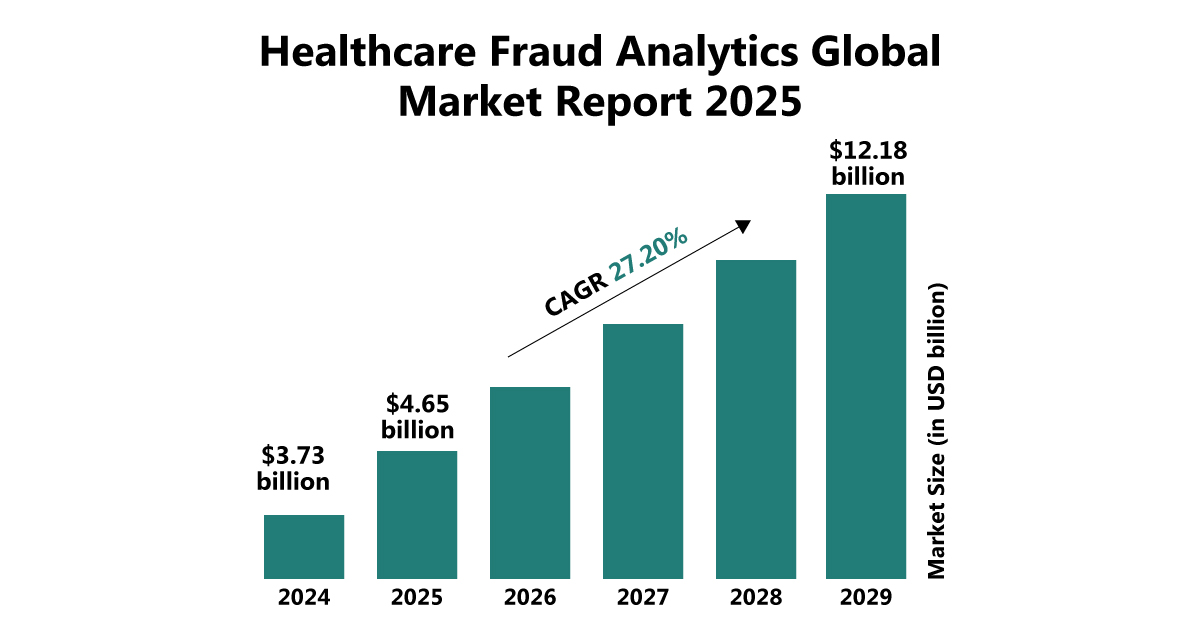

Source: The Business Research Company

Spot The Warning Signs In Your Health Bill

Unlike phishing emails or fake apps, phantom billing scams are more subtle and difficult to detect. However, there are several warning signs to watch for:

- Medical bills or Explanation of Benefits (EOBs) that list providers or services you do not recognize. This could indicate a false entry made under your insurance profile.

- Charges for appointments or follow-ups you never booked or completed. Scammers often submit claims for fictitious sessions, assuming they will go unnoticed.

- A sudden increase in telehealth activity on your insurance records. If your history shows more visits than you actually attended, that is a clear red flag.

- Receiving prescriptions, medical summaries, or health records from unfamiliar sources. These documents may be automatically generated from fake claims.

- Duplicate or recurring charges for vague services such as “check-ins” or “health status reviews.” Be cautious of repeated low-cost services designed to stay under your radar.

Patients should review every telehealth bill and question suspicious charges. Our health and wellness conference addresses scam offenses related to phantom billing, urging attendees to detect fraud early and report irregularities. Experts emphasized that staying informed is key to protecting both finances and trust in today’s virtual healthcare environment.

Actionable Ways To Protect Against Phantom Telehealth Bills

Protecting against phantom billing starts with awareness and simple steps. At the Health 2.0 Conference, experts highlighted the rise of scam offenses and urged patients, providers, and insurers to remain vigilant. Taking action early can help prevent financial loss and maintain trust in the evolving world of virtual healthcare.

Here are steps you can take to stay protected:

- Review your insurance EOBs and billing statements on a monthly basis. Checking regularly allows you to spot errors or unfamiliar charges before they become a problem.

- Confirm every telehealth charge with your healthcare provider or the platform used. If a service seems unfamiliar, ask for documentation or proof of appointment.

- Limit sharing of personal health data through unverified apps or online forms. Oversharing can give scammers the information they need to submit false claims.

- Use telehealth platforms that provide detailed visit records. Look for services that include timestamps, provider credentials, and session summaries.

- Report any suspicious billing activity immediately. Notify your insurance company, healthcare provider, or a relevant fraud reporting authority if something does not add up.

Implementing these steps can help individuals and organizations prevent financial loss and maintain trust in the virtual care experience.

Who’s Most At Risk Of Phantom Telehealth Scams?

While prevention strategies are essential, it is equally important to understand who is most likely to be targeted by these billing scams. Recognizing vulnerable groups helps sharpen our collective defense and allows providers and insurers to tailor solutions more effectively.

- Elderly patients and seniors are particularly vulnerable, as they may have multiple appointments, complex treatment plans, and less familiarity with digital records or billing platforms.

- People with chronic conditions who frequently use telehealth services may overlook duplicate charges or mistake them for legitimate recurring visits.

- Caregivers managing healthcare on behalf of others can miss signs of fraud if they are not involved in every appointment or lack direct communication with providers.

- Patients using third-party apps or external scheduling services might unknowingly share data that is later used in false billing schemes.

- Individuals with high-deductible health plans are more likely to scrutinize charges, but they may still be caught off guard by detailed or unfamiliar medical codes.

Understanding who is most at risk allows stakeholders to strengthen defenses where they matter most. Insights shared at our health and wellness conference highlighted how scam offenses target vulnerable groups, underscoring the need for customized safeguards and heightened awareness in a rapidly evolving digital healthcare environment.

Key Insights For Tackling Virtual Healthcare Fraud

Phantom telehealth billing continues to raise serious concerns as virtual care becomes more mainstream. These deceptive practices often go unnoticed until the damage is done, making proactive awareness essential. At the Health 2.0 Conference, speakers issued timely fraud alerts, stressing how unchecked billing systems can allow fraudulent activity to thrive in digital healthcare environments.

Meanwhile, the 2025 global health conference addressed emerging scam offenses that exploit gaps in telehealth security and patient oversight. Industry experts called for stronger safeguards, patient education, and greater accountability to curb this growing threat. As digital healthcare evolves, protecting patient trust and financial integrity must remain a shared priority.

FAQs

Q. What role do third-party billing services play in phantom charges?

A. Some billing errors or scams originate from third-party processors who may misuse patient data or submit false claims without provider oversight. Vetting billing vendors is a critical step for clinics.

Q. How can patients document and dispute a suspicious telehealth bill?

A. Patients should request detailed statements, take screenshots of virtual visit histories, and contact both their provider and insurance company. A paper trail makes disputes easier and more effective.

Q. Is there any regulation that covers phantom billing in virtual care?

A. While there isn’t yet a specific law solely for phantom billing, healthcare fraud falls under broader statutes like the False Claims Act. Regulators are increasingly focusing on telehealth-specific violations.

Q. How does the Health 2.0 Conference help providers stay ahead of scam offenses?

A. By bringing together regulators, tech innovators, and healthcare professionals, the event fosters dialogue on current scams and provides a platform for training and collaboration.

Q. How did attendees respond to scam alerts discussed at the Health 2.0 Conference?

A. Many attendees found the fraud alerts eye-opening and committed to auditing their systems or questioning their current billing protocols to reduce risk.